Any increase in your interest rate can lead to a higher monthly payment and paying thousands of dollars more over the course of a loan. Knowing your auto-related credit score can be useful when financing a car, since it can affect your loan terms and rates. The easiest way to check all four FICO Auto Scores at the same time is through FICO's credit monitoring service. It considers things like: have you consistently made your loan payments, and on time? FICO Auto Scores range from 250 to 900 and have several versions, including FICO Auto Scores 2, 4, 5 and 8.

The FICO Auto Score considers your usual credit behaviors but puts more emphasis on how you've managed auto loan payments in the past.

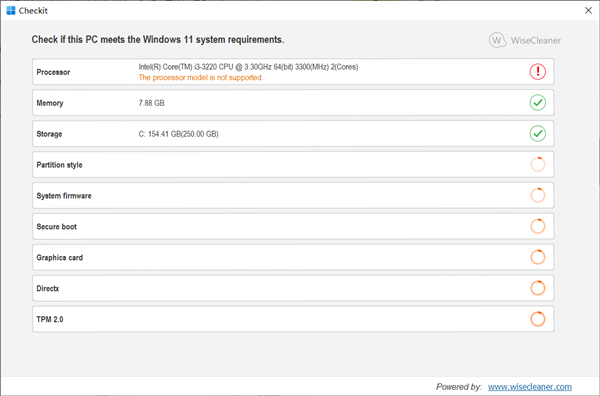

This App comes as a Lite version (offline) or online SAAS version. (Check out the full list of FICO's score versions for different financial products.) Just like a standard credit score, your industry-specific score helps determine future loan terms and interest rates. CheckIT is a User-Friendly, Super Fast, Easy to Use Digital Testing Management System, originally designed on a Next Gen PHP framework calleed FYNX (pronounced: finix), with various awesome Features that would make managing a Testing section not just Efficient, but Fun. Your best bet, however, would be to check something called an industry-specific score.įICO provides industry-specific scores that consumers can refer to when making certain purchases like a car or home. Different car lenders check different credit scores, so you won't know for sure which one they will look at when determining your auto loan application.

0 kommentar(er)

0 kommentar(er)